Automated Protection on Aave

Do you remember Black Thursday? For those of you who don’t know, it was a massive liquidation of MakerDAO positions when ETH fell 43% from $194 to $111, and millions of dollars were liquidated, affecting almost everyone in DeFi at the time (March 2020).

This was the first of many liquidations that shook the industry, making people second-guess the promise DeFi held.

A lot has changed since March 2020, though protocols have emerged with better security and algorithmic measures. They also have increased liquidation ratios, allowing users to borrow more against their collateral.

DeFi protocols ensure automated liquidations but forget to automate not being liquidated.

Instadapp introduced Protection Automation for Aave v2 and v3. This feature allows you to automatically unwind your position to pay down debt when a position becomes risky.

Setting up Protection on Aave v2 and v3

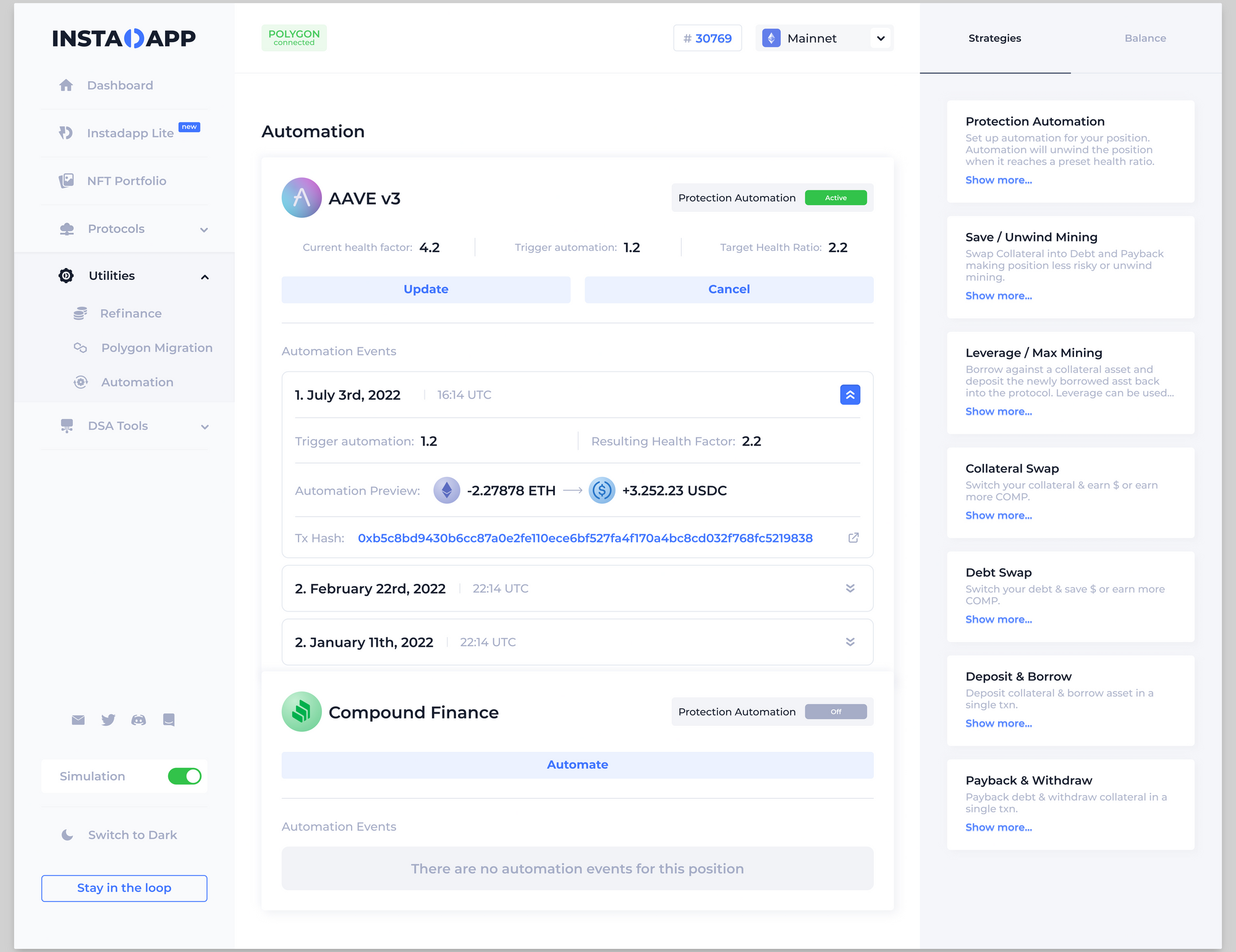

You can find the Protection Automation on the Strategies tab.

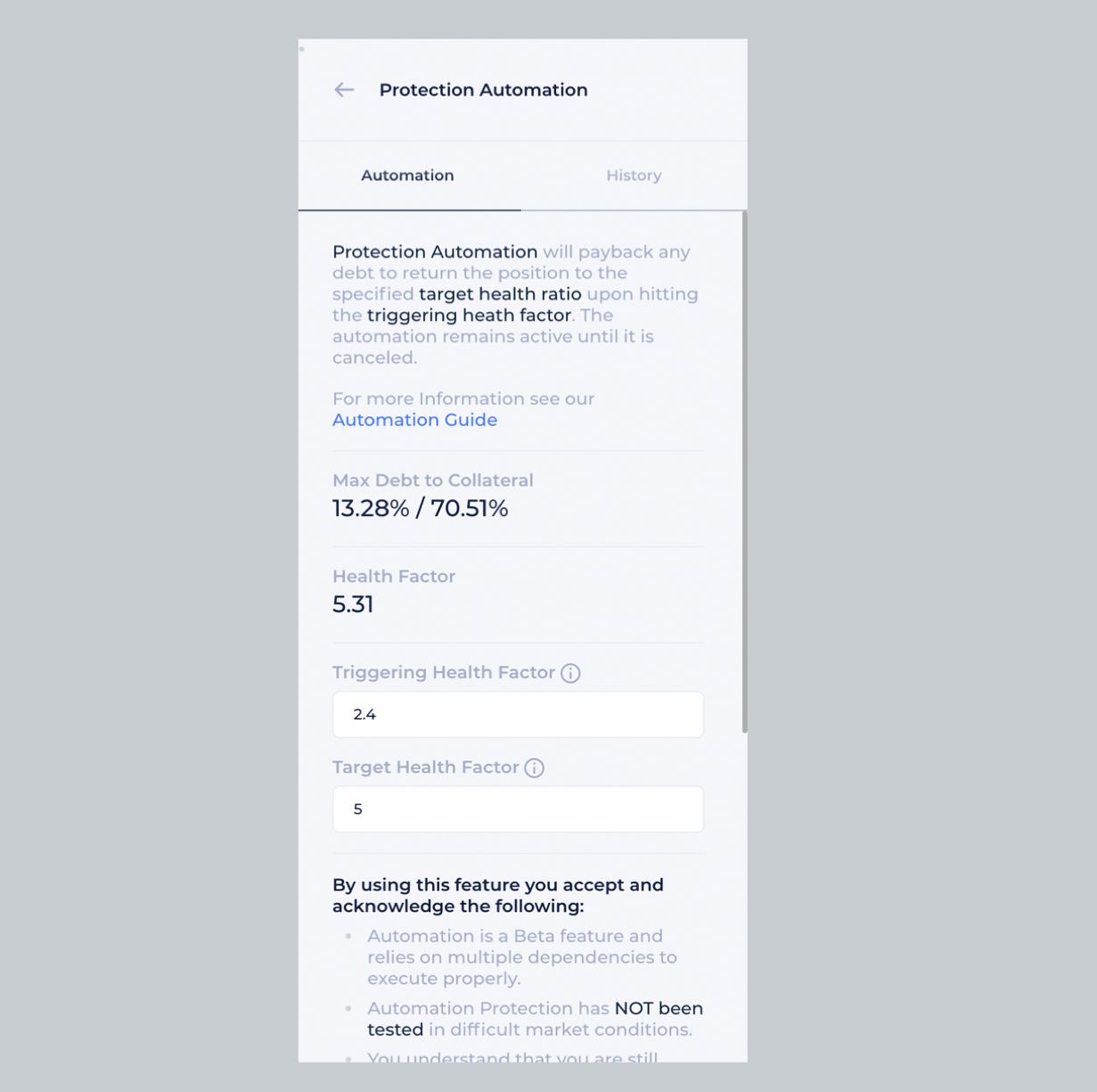

Set the Trigger Health Factor and Target Health Factor

Trigger Health Factor represents when the automation should occur. You can see your current risk factor and enter a value that is lower than your current health factor.

Whenever the position's health factor falls below the triggering health factor protection automation will submit a transaction to SAVE the position.

Target Health Factor determines how much the automation will pay back. You can set the desired Health Factor, and automation will pay back your position to this level.

Once done, click on Automate to set the Automation up.

Reviewing Automations

To get a full history of your automation transactions, go to the Utilities section, and click on Automation to view them.

Conclusion

One thing remains constant in this industry, and that's market volatility. Turn Automation on the portal to save your positions from being liquidated unexpectedly in difficult market conditions. Simply put, prevention is better than losing your assets, especially if it only takes one click to protect your positions.

Head over to Aave v2 or Aave v3 on Instadapp, and turn on Automation.

Quick FAQs

Q. Is there a minimum value of collateral assets?

Automation requires a minimum value of collateral assets. This minimum is only required when activating Protection Automation.

- Mainnet: a minimum of $15,000 USD worth of collateral to activate Automation.

- Polygon: a minimum of $1000 USD worth of collateral to activate Automation.

- Avalanche: a minimum of $5000 USD worth of collateral to activate Automation.

Q. Want to set up to close the position when the price goes above Triggered Health Factor?

Set the Target Health Factor to 1000 if you would like Protection Automation to pay back all the debt when triggered.

Q. How do I cancel an Automation?

Protection Automation will remain active until it is turned off. You can turn automation off in the Automation panel using the Cancel button. During a market downturn, the automation may run multiple times, each time returning the position to the target health ratio.

Q. What asset will be used to pay back the debt using Automation?

Once protection automation is activated, it will use any available collateral in the position during automation to pay back debt.

Q. Are there any fees?

For Automation on Mainnet, you will also pay the gas required to execute the automation. This fee will be paid through the collateral in the position. There is also a 0.3% - 0.4% fee per automation event.

Note: Automation is a Beta release, and has not gone through difficult market conditions to test its resilience. You should continue to monitor your positions even after setting up Automation and use at your own risk.

Learn more about Instadapp by following us on Twitter for regular updates and launches, get to know us closely, and ask us those hard questions (or just say hi) up front on Discord. Nonetheless, if you need to contact us, feel free to email us.