Compound III on Instadapp

Focusing on single-asset borrowing.

Compound Finance is known as the pioneer of decentralized peer-to-peer lending markets. The recent launch of v3, code-named 'Comet,' is an exciting follow-up to Compound v1 and v2, driven with an emphasis on security and ease of use.

The biggest change is a realigned focus on borrowers. This means only one ‘base asset’ is supported for borrowing while other crypto assets are supplied as collateral.

Unlike v2, which used a pooled-risk model, users could borrow any asset. Just as they say, one bad apple can spoil the whole bunch; a single faulty asset could drain the entire protocol.

You can read the full change log here on the forum post. In this post, we will try to highlight the major changes we are excited about.

Compared to v2, how is v3 secured?

This change to single-asset borrowing increases security, as no one can borrow the collateral you supplied. Under each market, you can only supply supported collateral, but you can only borrow a single asset. Currently, the supported market is the USDC base asset, with ETH, COMP, LINK, UNI, and WBTC being the supporting collateral.

Your collateral is more secure, risk is managed better, and capital efficiency is improved. It's ingenious!

Compound also mentions that there will be more base markets in the future; DAI and ETH are the most probable. This is most likely to happen on a second deployment with confirmation from the community via governance.

So, there won’t be any interest on supplied collateral anymore?

This security update comes with a caveat; since borrowers would not be borrowing your collateral, they won’t be paying any interest. On Compound v3, you won’t earn any interest on supplied collateral.

However, you will be able to borrow more, with less liquidation risk and lower liquidation penalties, while spending less on gas.

You can earn interest on the base asset (USDC in this case) by supplying the base asset.

Decoupled supply and borrow rates

On Compound v2, supply and borrow rates were codependent. In v3, on the other hand, both rates are calculated separately. These rate models are set by the governance which can more proactively set these two different rates.

For example, Compound governance can decide to set a higher borrowing rate and a lower supply rate. If the borrowing rate is 40% and the supply rate is 20%. This difference of 20% can go to the protocol’s reserve as revenue and differs from the static models from Compound v1 and v2.

What if the supply rate goes higher than the borrowing rate? How will the extra interest be paid to suppliers?

This is most likely a rare occurrence; if it does happen, it will be paid from the Compound’s reserve. Regardless, the protocol is still safe in these circumstances and is earning any excesses.

How will the liquidation system work?

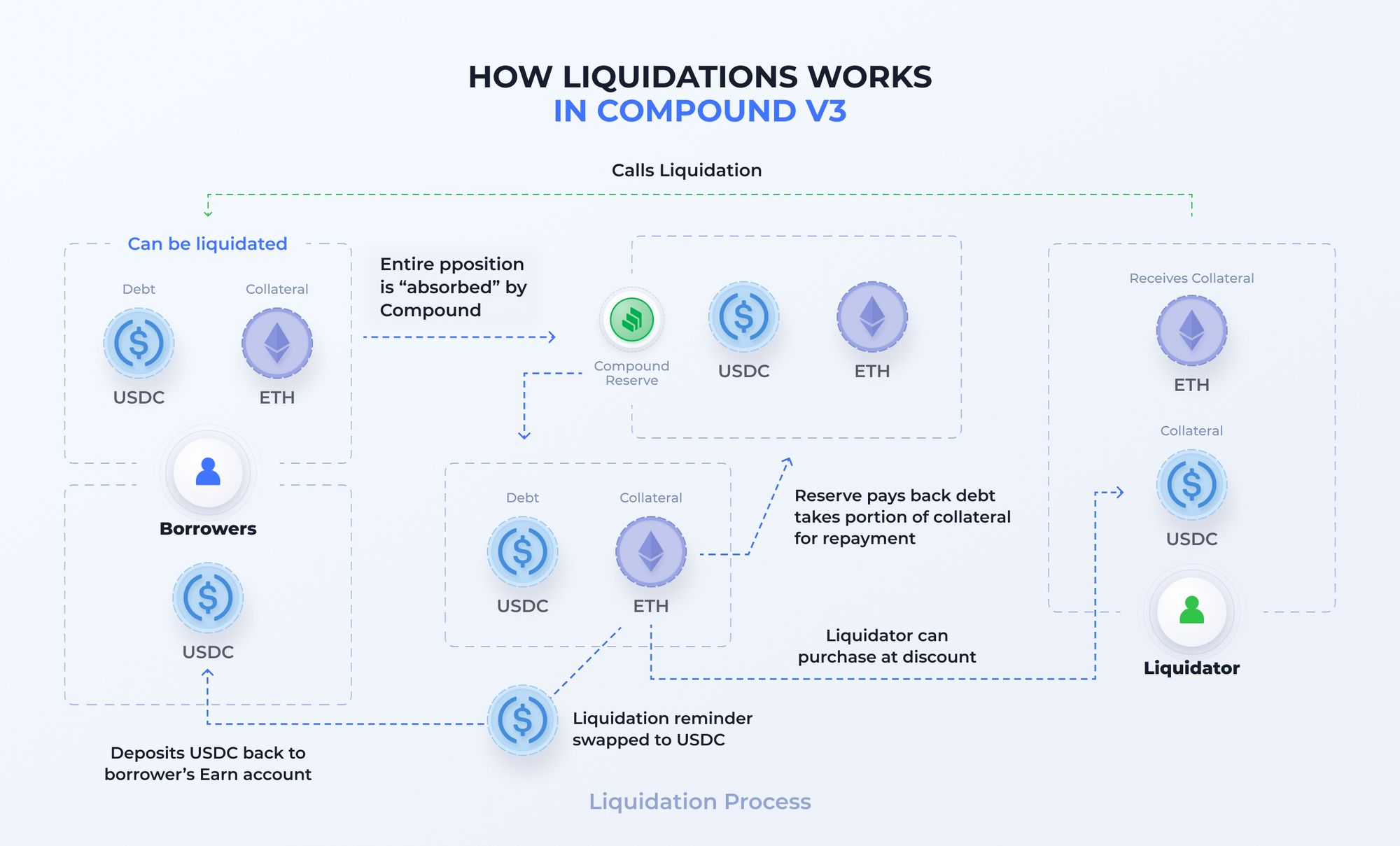

The liquidation system in Compounds v3 is optimized. When your borrow balance exceeds the liquidation limit, it triggers liquidation. The liquidator “absorbs” the ownership of your position, and your debt is paid back using the collateral. The remaining collateral, minus the liquidation penalty, is returned to you in the base asset.

All liquidations on Compound settle the position.

Compound v3 also introduces changes to how it handles bad debt. When a user is liquidated on Compound, no matter what you deposit as collateral after liquidation, your remaining balance would be converted to interest-earning USDC (in this case).

Let’s say you had deposited ETH, UNI, and LINK collateral and had borrowed USDC up to the point of liquidation. Let's say just LINK fell in price and you were liquidated, after the liquidation, the protocol would settle all your collateral assets and only return the remainder as USDC supplied to Compound.

This liquidation is called an ‘absorption’ as the liquidation is initially paid for by Compounds reserve. These improvements ensure the Compound can offer better rates in exchange for a more streamlined liquidation process.

What's the liquidation penalty?

It varies for each collateral asset ranging from 5 to 7%.

How are prices validated?

Compound version 3 employs Chainlink as the protocol’s exclusive price feed, which simplifies governance smart contracts and will enhance the system’s security and scalability. This will also be portable to EVM chains beyond Ethereum.

Governance will be able to modify this decision in the future.

What role does Governance play in v3?

As Robert puts it, Compound III is controlled & owned by the community. All decisions, from price oracles to supply and borrow rates, depend on governance. Compound also acquired a Business Source License (BSL), which means forking the protocol requires community permission as well.

Improvements for Account Management on Comet

Compound III shines like a comet with new advanced account management features. Compound accounts can enable different users or addresses to have permissioned access to parts of their Compound accounts.

For example, you could whitelist another address to pay back debt in your Compound position or grant a protocol the ability to borrow from your account for a fee.

These authority models will assist in building new compelling use cases in the future.

Conclusion

Compound has taken a simpler, more efficient and safer route to becoming a leader in USDC borrowing. In the world of DeFi lending protocols, if there are no external rewards, Compound Comet looks like it's in it for the long run.

Manage your Compound on Instadapp.

Read our guide on how to manage your Compound positions on Instadapp here.

Learn more about Instadapp by following us on Twitter for regular updates and launches, get to know us closely, and ask us those hard questions (or just say hi) up front on Discord. Nonetheless, if you need to contact us, feel free to email us.